If you’re searching for information about Parwaz Card registration in Punjab, your primary question is likely: “Is Parwaz Card Registration Free in Punjab 2026?” The answer is a definitive YES – Parwaz Card registration in Punjab is 100% completely free with no hidden charges, processing fees, or approval costs. The Government of Punjab has officially confirmed that all Parwaz Card services are absolutely free for eligible applicants.

“Is Parwaz Card Registration Free in Punjab 2026?” want immediate confirmation that there are no registration fees, want to understand the complete application process, and seek guidance on how to apply safely without falling victim to unauthorized agents or scams. This comprehensive guide addresses all these essential concerns with verified information from official government sources.

Parwaz Card Registration Free – Official Government Confirmation

The Government of Punjab, under the leadership of Chief Minister Maryam Nawaz Sharif, has officially declared that Parwaz Card registration is completely free. Zero charges apply at any stage of the application process – from initial registration to final verification and loan disbursement. This government-backed welfare initiative ensures that financial barriers do not prevent eligible citizens from accessing interest-free loans and skill development opportunities.

Is Parwaz Card Registration Free in Punjab 2026?, No registration fees exist for the Parwaz Card program. There are no processing charges, verification fees, application costs, or approval payments required. The entire system operates on taxpayer funds managed by the Government of Punjab specifically to support youth empowerment, overseas employment, and small business development. Any individual, agent, or unofficial website claiming to charge money for Parwaz Card services is committing fraud.

The Official Punjab Government explicitly warns all potential applicants to never pay money to unauthorized agents, unofficial websites, or third-party intermediaries. Legitimate Parwaz Card applications are submitted directly through the official portal at parwaz.punjab.gov.pk or specific portals like psdf.org.pk/parwaaz-card for skill training categories. All legitimate government communication comes exclusively from official .gov.pk or .psdf.org.pk domains.

Parwaz Card Program Overview – What You Need to Know

The Parwaz Card CM Punjab Program is a major welfare initiative introduced by the Punjab Government to support eligible citizens through structured financial assistance, skill training, and overseas employment facilitation. The program operates under two main categories: Overseas Employment Support and Business Loans (Asaan Karobar).

Parwaz Card for Overseas Employment provides interest-free financial support up to Rs 1,000,000 to help Pakistani youth access verified international job opportunities in countries like UAE, Saudi Arabia, Italy, Oman, Qatar, and other employment-friendly nations. This category covers pre-departure costs including visa fees, passport expenses, medical tests, air tickets, and skill verification charges.

Parwaz Card for Business (Asaan Karobar) offers interest-free loans up to Rs 30 lakh (Rs 3,000,000) for small business owners, startups, and self-employed individuals who want to start new businesses or expand existing enterprises. This category supports sustainable economic growth and job creation across Punjab.

Both categories follow a completely transparent, merit-based process with digital verification, online tracking, and government oversight to prevent fraud and ensure accountability. The entire application procedure is designed to be simple, secure, and completely free.

Complete Eligibility Criteria for Parwaz Card Registration in Punjab

Before applying for Parwaz Card, you must meet specific eligibility requirements set by the Government of Punjab. Understanding these criteria ensures you don’t waste time on a doomed application.

Basic Eligibility Requirements

- Citizenship: Must be a Pakistani citizen with valid CNIC (Computerized National Identity Card)

- Residency: Must be a resident of Punjab province for at least 2-3 years

- Age: Must be between 25-55 years old (some categories may have different age limits)

- Income: No specific income ceiling for overseas employment category, but business category requires proof of viable business plan

- Education: Minimum intermediate (12th grade) or equivalent qualification required

- NTN Registration: Active National Tax Number (NTN) required for business category

Category-Specific Requirements

For Overseas Employment:

- Must have genuine job offer letter from verified foreign employer

- Must complete skill verification or professional assessment

- Must not have criminal record or security concerns

- Must meet skill requirements of the employing country

For Business Loans:

- Must have viable business plan with financial projections

- Must demonstrate basic business knowledge or experience

- Can be a startup or existing business

- Must not have any outstanding loans or black listing in financial institutions

Complete Step-by-Step Application Process for Parwaz Card Registration

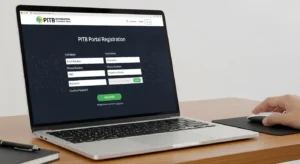

Step 1 – Visit Official Registration Portal

Visit the official Government of Punjab portal at parwaz.punjab.gov.pk. For overseas skill training, visit psdf.org.pk/parwaaz-card. Ensure the URL ends with .gov.pk or .psdf.org.pk – any other domain is fraudulent and unsafe.

Step 2 – Create Your Account

Enter your 13-digit CNIC number (without spaces or dashes) and your registered mobile number. You will immediately receive an OTP (One-Time Password) via SMS. Enter this OTP to verify your account. Ensure your mobile number is registered with NADRA under your CNIC.

Step 3 – Select Your Application Category

Choose one category only: either Overseas Employment or Business Loan (Asaan Karobar). This selection cannot be changed after submission, so choose carefully. Multiple applications or category switching can result in permanent disqualification.

Step 4 – Fill Application Details

Enter your personal information, educational background, employment history, and business details (if applicable) exactly as shown in your original documents. Any discrepancies between form data and uploaded documents can cause automatic rejection.

Step 5 – Upload Required Documents

Upload clear, color scanned copies of all required documents:

- CNIC (front and back)

- Passport-size photograph (recent, clear)

- Educational certificates (intermediate/Bachelor degree or higher)

- Job offer letter (for overseas category only)

- Business registration (for business category)

- Tax certificate or bank statements (for business category)

Step 6 – Review and Submit

Carefully review all entered information against your uploaded documents. Ensure no spelling mistakes, incorrect dates, or missing information. Click Submit and you will receive a Tracking ID to monitor your application status.

Important Documents Required for Parwaz Card Registration

| Document Type | Required For | Specifications |

|---|---|---|

| CNIC | All applicants | Color copy, both sides, valid |

| Passport | Overseas category | Valid for 6+ months |

| Job Offer | Overseas employment | From verified employer |

| Educational Cert | All applicants | Intermediate or Bachelor’s |

| NTN | Business category | Active National Tax Number |

| Business Plan | Business category | Financial projections |

| Domicile | All applicants | Valid provincial domicile |

| Photograph | All applicants | Color, recent, 4×6 size |

Common Mistakes That Cause Parwaz Card Application Rejection

Understanding common mistakes helps you avoid rejection and improve approval chances. The top reasons for rejection include:

Applying Through Unauthorized Agents or Middlemen

Never use agents to submit your Parwaz Card application. The official system is designed for direct submission only. Agents often submit incorrect information, access your personal data improperly, or charge illegal fees. Applications submitted through unauthorized sources are automatically flagged and rejected with permanent disqualification.

Selecting Wrong Application Category

Incorrect category selection is a major rejection cause. You must carefully choose between Overseas Employment and Business Loan before submission. Changing categories after initial submission is impossible, and multiple applications in different categories result in immediate disqualification.

Incomplete or Inaccurate Information

Missing details, spelling errors, incorrect dates, or information mismatches between your form and uploaded documents cause automatic rejection. The system performs automated verification comparing your application data with NADRA, tax records, and document images.

Poor Quality or Missing Documents

Unclear scans, black and white copies, expired documents, or incomplete document sets result in application rejection. All documents must be clear, color, recent, and properly readable.

Interest-Free Loan Details – How Parwaz Card Financing Works

The Parwaz Card provides interest-free financing (known as Qarz-e-Hasna in Islamic finance) for eligible applicants. The loan structure varies by category:

Overseas Employment Loans

Maximum loan amount: Rs 1,000,000 (10 lakh) Loan purpose: Pre-departure costs including visa fees, passport, medical tests, air tickets, skill verification Disbursement: 20% in cash initially, 80% via documented expense reimbursement Repayment: Interest-free, repay only the principal amount with flexible terms Approval timeline: 7-10 working days from submission date

Business Loans (Asaan Karobar)

Tier 1: Up to Rs 5 lakh without collateral requirements Tier 2: Up to Rs 30 lakh with collateral or guarantor Loan purpose: Business setup, expansion, equipment purchase, inventory funding Repayment: Completely interest-free, repay principal only Repayment period: Up to 5 years with flexible monthly installments Grace period: 3-6 months before repayment begins

Safety Tips – Protect Yourself from Parwaz Card Scams

The popularity of Parwaz Card has attracted fraudsters who prey on unsuspecting applicants. Protect yourself with these essential safety measures:

Never Share OTP or Personal Information

Never share your OTP (One-Time Password) with anyone, including claimed government officials. The legitimate system never requests your OTP via phone call or message. Government staff will never ask for your password, OTP, or CNIC details.

Only Use Official Government Portals

Apply exclusively through official portals:

- parwaz.punjab.gov.pk (main portal)

- psdf.org.pk/parwaaz-card (skill training)

Any other website claiming to be Parwaz Card portal is fraudulent. Avoid WhatsApp groups, social media pages, private websites, or agents offering to submit your application.

No Fees at Any Stage

Zero charges exist at any application stage. Anyone demanding registration fee, processing fee, approval payment, or document verification charges is committing fraud. The entire process is 100% free.

Verify Government Warnings

The Government of Punjab regularly issues public alerts about fake agents and scam websites. Check the official Punjab portal for latest fraud warnings and list of registered dealers/agents (if any exist for specific services).

Frequently Asked Questions

Conclusion

The answer to “Is Parwaz Card registration free in Punjab?” is a resounding YES. The Parwaz Card Registration Portal 2026 offers a genuine, transparent, government-backed opportunity for eligible Pakistani citizens to access interest-free financing, skill development, and overseas employment facilitation with absolutely no charges or hidden fees.

Remember these critical points: Apply directly through official portals only, never share personal information with agents, avoid unauthorized websites, and report any fraud to official authorities. The Government of Punjab has invested significant resources and taxpayer funds into this program specifically to support youth and empower citizens without financial burden.

If you meet the eligibility criteria, have a genuine interest in overseas employment or business development, and are willing to complete the application honestly, submit your Parwaz Card application today. The approval process is transparent, the financing is interest-free, and the government is fully committed to supporting your success. Visit parwaz.punjab.gov.pk or psdf.org.pk now to start your application journey toward a better financial future.